Driver - Guide to the protection and insurance cover

When you rent a car on Getaround, you are automatically covered by insurance. Depending on the protection level you choose, the amount you might need to pay in case of a problem will vary. Here’s everything you need to know to drive with peace of mind!

What are the available protection levels?

You can choose from three protection levels: Limited, Essential, and Premium. Each level determines how much you may need to pay if the car is damaged during your rental.

Limited Protection (included by default)

- This is the default option.

- In case of damage, you could pay up to €1,100 (this is called the “deductible”).

- A security deposit is blocked on your bank card at the start of the rental.

Essential Protection (paid option)

- The deductible is reduced to €250.

- A reduced security deposit is blocked on your bank card at the start of the rental.

- You pay a bit more at the time of booking, but you’re better covered in case of an incident.

Premium Protection (paid option)

- No deductible to pay! If damage occurs and is covered by the insurance, you won’t have to pay anything.

- A reduced security deposit is blocked on your bank card at the start of the rental.

- Ideal for peace of mind!

Good to know:

- You can add or modify your protection before the rental starts. Once the rental begins, you cannot change it.

- The Premium option does not cover everything (see the exclusions section below).

- The Essential and Premium options are offered under certain conditions (e.g., vehicle category).

What is covered by the insurance?

Getaround insurance covers external damage to the vehicle as well as accidents involving another driver. Your deductible applies.

If the car is stolen, you are also covered (but you may still have to pay a sum depending on your protection level).

What is covered (you only pay your deductible):

- Accidents

- Theft of the vehicle

- Fires

- Glass breakage (windshield, windows)

What is NOT covered (you pay the total cost of repairs):

- Flat tires

- Wrong fuel (for example, putting diesel instead of petrol)

- Lost or broken keys

- Damage to the inside of the car (seats, dashboard, etc.)

- Normal wear and tear (tires, brakes, etc.)

Important: To ensure insurance coverage, you must follow Getaround’s rental rules:

- You must have a valid driver’s license (not expired or suspended).

- You must be the only driver. If someone else drives the car without being registered as a driver, insurance will cover nothing.

- You must not be under the influence of alcohol, drugs, or medications that impair driving.

- You must respect the traffic laws (speeding, red lights, etc.).

- No racing, rallies, or competitions.

- No professional use such as taxi/ridesharing, delivery, or transport of goods.

- No sub-renting the vehicle.

Driving abroad: in which countries are you covered?

Getaround’s insurance and assistance cover your rental if you drive only in the following authorized countries:

Germany, Andorra, Austria, Belgium, Denmark, Spain, Finland, France (mainland and Reunion Island), Hungary, Liechtenstein, Luxembourg, Monaco, Norway, Netherlands, Poland, Portugal, Czech Republic, United Kingdom, Slovakia, Slovenia, Sweden, Switzerland.

Before your departure: Check that your driver’s license is valid in the country you are visiting. Make sure the vehicle meets local requirements (e.g., mandatory equipment).

If you decide to drive in a country not listed, all repatriation and/or repair costs in case of breakdown or damage will be at your expense.

The list of authorized countries is final: no external insurance or agreement with the owner can extend coverage to another country.

What do you have to pay in case of damage?

This depends on your protection level and the situation:

If you are responsible or if the responsible party is not identified:

- You will pay up to your deductible (e.g., €250 if you chose Essential Protection) plus a €45 processing fee.

- If there are multiple damages, you will pay a deductible for each damage (the processing fee applies only once).

If a third party is responsible and identified:

- No worries, the third party’s insurance will cover the repairs.

- You may temporarily be debited the deductible, but it will be refunded once insurance confirms you are not at fault.

And the security deposit?

- It is used to guarantee that you can pay a potential deductible or other fees, penalties, etc.

- If everything goes well during the rental, it will be released a few days after the rental ends.

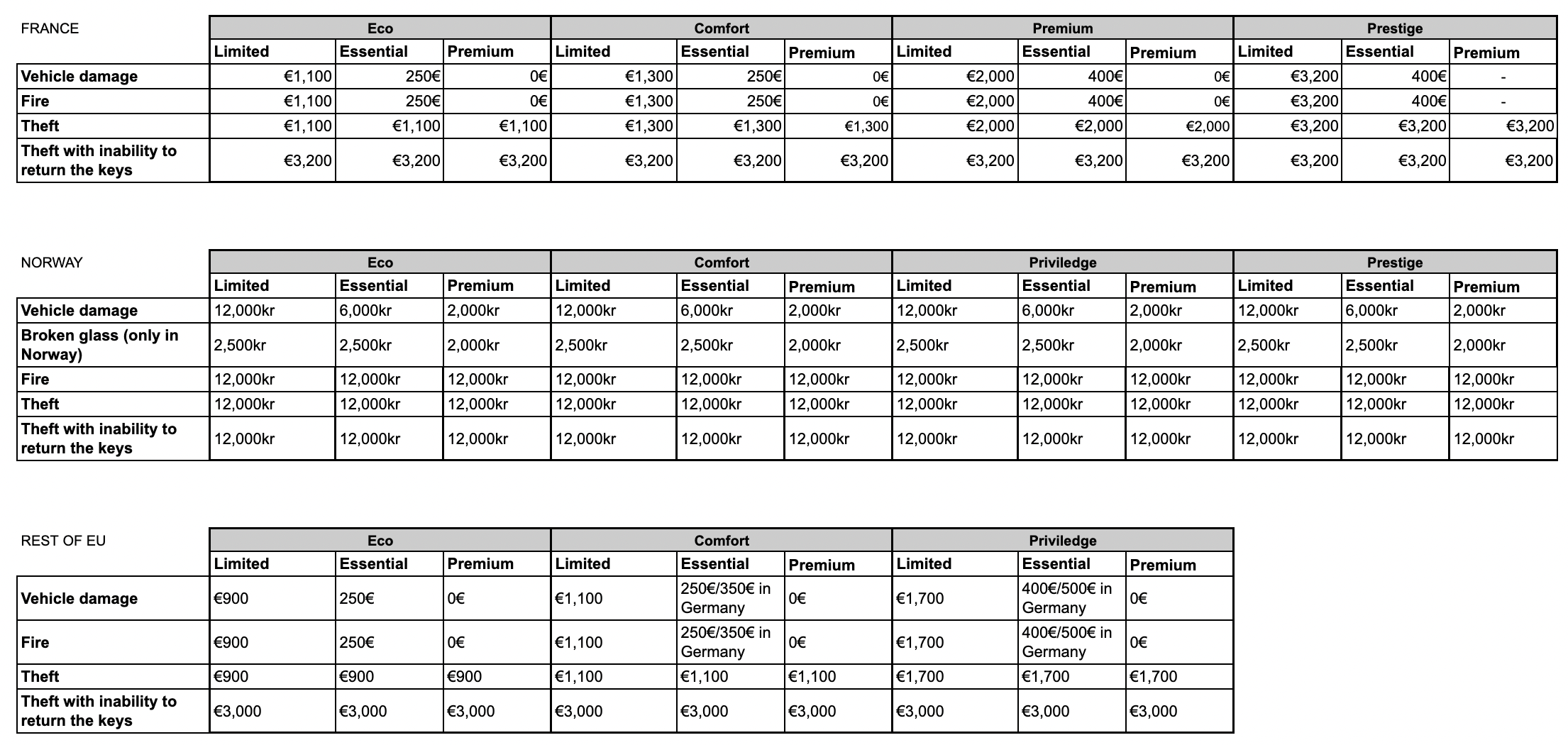

Deductibles by country:

Please note: the deductible does not apply to interior damages. If you damage the car's interior, you will be charged the full repair costs.

Will my Visa Premier, Mastercard Gold or American Express card refund me the insurance deductible?

No, Visa Premier, Mastercard Gold and American Express cards insurance do not cover peer-to-peer car rental and will not refund you your insurance deductible. Only rentals made through a professional hire company are covered by their insurance.